Applying for a home loan isn’t just about appraisals and choosing the right financing program. It’s also about your lender looking at and verifying your credit profile. Did you know that any changes to your credit profile during the loan process can have negative ramifications?

Here are a few tips and tricks I’ve put together that can help you save yourself a headache or two during the loan process.

Stay on top of paying off your existing credit accounts. One late payment can jeopardize your qualification for a home loan.

Continue to use your credit as normal. If you change the way you use credit, it could actually lower your credit score.

Call me or text if you have any questions. 765-532-1604

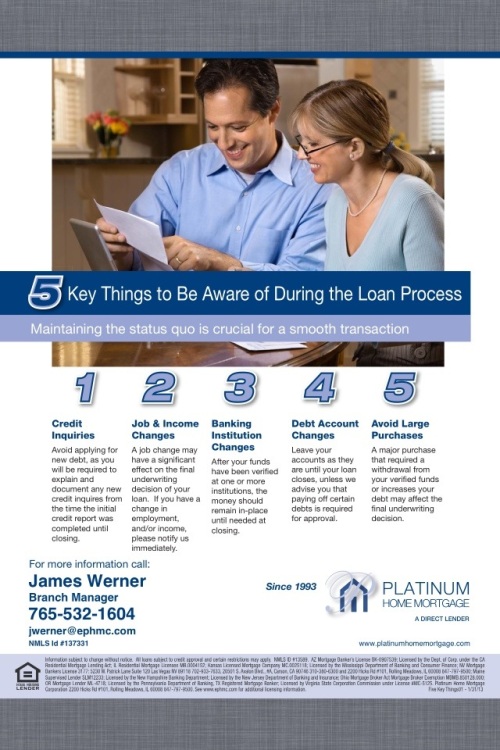

Don’t apply for new credit. New credit obligations can impact your debt profile and jeopardize your qualification.

Don’t close credit card accounts unless your financial advisor tells you it would be beneficial.

Don’t max out or over-charge credit cards. Keeping credit card balances at least 10 percent below the maximum should help you maintain your current credit score.

Here a few other things to keep in mind during the home loan process.

Job changes can significantly affect your loan. If you have a change in income or employment, notify your loan officer immediately.

Don’t move your money around. After your funds have been verified at one more institutions, the money should remain in place until the loan process is done.

Avoid Large Purchases. A home loan should be a big enough purchase in itself, but keep in mind that a large purchase that requires withdrawal from verified funds or increases your debt can hurt your ability to get a home loan.

James Werner

NMLS ID# 137331

765-532-1604