Rent vs. Purchase: Which Is Right For You?

Renting versus purchasing depends on many factors. In today’s market, the most immediate concerns are rapid rent and home price increases and current interest rates.

Rental vacancies are at 10-year lows. Renters make up about 35 percent of the U.S. households. This percentage will only grow over the next 10 years, as Baby Boomers downsize and 20-somethings move out of their parents’ homes. A shortage of rental housing will increase demand… and rents.

Consider the Costs

If you are or are planning to rent, these are some associated costs:

- Initial Costs: Security deposit

- Yearly Costs: Monthly rent and renter’s insurance

- Early Release Costs: Security deposit and all month’s rent remaining on the lease agreement

If you are planning to purchase a home, here are some costs to consider:

- Purchase Costs: Down payment and closing costs

- Yearly Costs: Monthly mortgage payment, condo/community fees, renovation costs, maintenance costs, property taxes, and homeowner’s insurance

Length of Stay

If you are planning to stay in one location for at least seven years, purchasing is usually your best option. Look at your particular situation and where you plan to be in seven years: Will you change jobs? Will you start a family? Will you have more children?

Tax Benefits

The tax benefits of homeownership can be a nice perk, so talk to your tax consultant in order to make an informed decision regarding your particular financial situation.

Use this Rent vs. Buy Calculator to see what’s better for you.

To find out current rates or to get a payment quote call my Indiana Platinum Home Mortgage Office at 765-429-4444 or 1-888-830-3636.

Read more at our corporate blog site original atricle. http://blog.phmc.com/2014/02/18/purchase/rent-vs-purchase-which-is-right-for-you/

How FHA Financing Can Make Your Home Listing Stand Out

Wouldn’t it be a dream to purchase a home and not make any interest payments for the first six months? If you are planning to sell your home, how do you attract the highest number of prospective buyers?

Today, FHA financing is used for 30 percent of all home purchases.

FHA financing allows buyers to overcome many obstacles often associated with purchasing a home, including shortage of funds for the down payment and closing costs. See how FHA can help buyers move forward with their purchase of your home!

· Low Down Payment: Buyers can purchase a home with as little as 3.5 percent down with FHA financing.

· Seller-Paid Closing Costs: Sellers may contribute up to 6 percent of the sales price towards the buyer’s closing costs.

· Gifts: The buyer’s friends and family may provide 100 percent of the down payment and closing costs as a gift.

· Down Payment Assistance Programs: There are often state or local down payment assistance programs that can be used in conjunction with an FHA mortgage.

· Non-Occupying Co-Borrowers: To help the buyer qualify, FHA allows the buyer to have a co-borrower on the loan that will not be occupying the property.

All-in-one purchase and renovation financing for homes in need of minor or major work

FHA offers two renovation loans that allow buyers to finance the home, plus repairs that will increase the home’s value. Find out more about the FHA 203(k) Streamlined and Standard loans.

Offer your buyers no interest payments for up to 6 months

Six interest-free months are the terms offered as a part of Platinum’s exclusive Dream Loan© program, which has helped sell homes since 1996.

Helping buyers with low credit scores

Platinum offers an exclusive FHA Low FICO program, which allows maximum FHA financing for buyers with a credit score as low as 580.

Let your buyer assume your low interest rate loan

If you currently have an FHA loan, and the interest rate is lower than today’s market rates, your buyer can assume the remaining terms on the loan. This is also an important feature that your buyer can use in the future when they sell their FHA-financed home.

Personal touch financing and fast closings

Platinum Home Mortgage is a Direct Endorsement FHA lender, which means both the seller and buyer get the advantage of being able to close quickly. As a direct lender, we process, underwrite and close our loans in-house. No middlemen to slow the process down.

An important note

Each FHA program is subject to different qualifying guidelines. Find out which programs best fit your needs by contacting my local Platinum Home Mortgage branch office at 765-429-4444

Original Article at http://blog.phmc.com/2013/11/22/mortgage-program/how-fha-financing-can-make-your-home-listing-stand-out/

James Werner

Branch Manager

Platinum Home Mortgage

Nmls ID# 137331

Higher Price Mortgage Loans

What is a Higher Price Mortgage Loan? Let’s start with understanding what the price of a mortgage is. At my branch we have the ability in some cases for instance to fund a loan with no lender fees and even can give credits that may help pay for insurance and title charges or help cover pre paid items.

Some of these “no cost” loans are actually classified as “higher price mortgages” or HPML.

Hey wait how can something with no cost be higher priced?

Well it must carry a higher rate. Right? Well not exactly. Usually conventional loans have higher interest rates than FHA loans and a conventional loan at a higher note rate may not be classified as higher priced where a lower rate no closing cost FHA loan may be. What? Confused yet?

Well the state and federal government imposes limitations on mortgage lenders as to what they can charge right?

Yes they do.

In most states the limit to the amount of fees a lender can charge is about 3% to 5% total and some of that includes part of your odd days interest payment and the title company closing fees in Indiana. So yes the government protects you from being totally raped (our total lender charges usually do not exceed 2% if we have any at all) The rule called section 32 protects consumers from “high cost” loans… Well I know my loan is not high cost because that is basically illegal and new QM rules limit lenders to 3% if they want to avoid litigation….so then what is this “higher price” business?

No one wants a higher price loan do they?

Well…. it just depends.

If your circumstance dictates it or say….. you choose to put little money down… Or you require a government subsidized program that mandates additional mortgage insurance you may not have much choice and it is very likely your loan will be classified as “higher price”

What a higher price loan is in a nut shell is a loan where the APR is significantly higher than the average loan at a given time. 1.5% higher than than the average APR published weekly by Freddie Mac. It is important to realize that the average mortgage borrower is not a first time buyer with little to no money down.

Most FHA loans over 90% loan to value today will carry higher APRs due to the new inclusion of mortgage insurance that lasts the entire life of the loan.

As a consumer you should understand that the average borrower in America today is putting down larger down-payments or are refinancing with equity so they are not in the highest loan to value risk pools or in need of a higher price type of loan. These higher price disclosures are intended to educate borrowers that they may have other options and perhaps begin to ween us off of low down payment government loans. In most cases conventional mortgages though they may have higher note rates will have lower APRs than their lower note rate FHA counterparts because the monthly MI eventually drops off where FHA over 90% LTV is with you forever.

Here is a link to the FFIEC calculator to see if your loan is higher priced.

You will notice that the calculator does not ask questions about loan programs or loan to value. Because FHA today has mortgage insurance for the life of the loan and it is reflected in APR as a “Price” of doing business most FHA loans with under 10% down today are coming up as Higher Priced no matter what the note rate or closing costs.

More to come…

More Official Info Here

James Werner

Nmls ID # 137331

765-532-1604

Dream Loan (Platinum Exclusive Program)

Get the Home of Your Dreams with the Platinum DreamLoan©

Wouldn’t it be a dream to purchase a home and not make any interest payments for the first six months? Since 1996, we have been helping to make that dream a reality with our exclusive Platinum DreamLoan.

Why the Platinum DreamLoan?

Having extra cash after a real estate transaction is important. The absence of interest payments for up to six months helps to replenish the savings you used to make the down payment. Plus, cash reserves are always great to have in case of a rainy day.

Consider reducing the amount of interest you pay over the life of your loan by applying your savings towards your principal balance.

New homes typically require new furniture, appliances, carpet, and other household items. Use your monthly savings to decorate.

Reduce high interest rate installment and credit card debts during the interest-free period to streamline your budget. Six months of interest payments that don’t have to be made in the short-term can save you a lot in the long-term if you use your savings wisely.

Sellers can make their home stand out from the competition by offering the Platinum DreamLoan to their prospective buyers. Create a buzz around your home by offering a way to purchase the home in the autumn, but make no interest payments until spring.

Real estate professional know that using specialized financing attracts homebuyers and helps sell homes faster.

The Platinum DreamLoan is a win for everyone. Remember, you will only find this loan at Platinum Home Mortgage.

James Werner

NMLS ID#137331

765-429-4444

http://www.indianaplatinum.com

New FHA Program Drops Foreclosure Wait Time

|

The FHA Back to Work – Extenuating Circumstances program has arrived, providing Americans with the shortest possible path back to home ownership. It used to be that you would have to wait three years before applying for an FHA loan following a foreclosure, deed-in-lieu, short sale, or bankruptcy. Now, that wait has been shortened to just a year.

|

|||

|

The three-year waiting requirement was already the second-shortest wait of all mortgage backers. Only the VA’s two-year waiting requirement was shorter. By comparison, to get a Fannie Mae- or Freddie Mac-backed mortgage, the waiting requirement is seven years. In order to qualify for the loan, unforeseen events must have caused your household to lose 20 percent or more of its income for at least six months. Your past credit history must show your inability to pay was brought about by hard times and you have regained your ability to pay. You must demonstrate a full recovery from economic hardship, complete HUD-approved housing counseling and meet all other FHA requirements. To get started, contact a mortgage consultant for a housing consultation, which will include a review of your credit history and analysis of your financing options. FHA Back to Work-Extenuating Circumstances FAQ The Platinum experts answer your questions about the new program and how it changes the game for prospective homeowners. What is the FHA? The FHA is the Federal Housing Administration, a wing of the United States Department of Housing and Urban Development (HUD). FHA’s main function is operating as the world’s largest home loan insurer. The FHA insures loans in all 50 states and the District of Columbia. How does this change affect me? Previously, you had to wait a minimum two to three years following foreclosure — or another event — before you would be eligible to receive an FHA loan. They are now dropping that requirement to one year, provided you qualify for this program. How do I document I lost 20 percent of my income? You’re going to need one of the following to prove your prior income:

Also, if your dip in income was related to seasonal or part-time employment, you must produce two years of records to prove the loss. How do I prove my credit is back in good standing? Your lender will review your credit report as a part of the loan application process. All your credit accounts are reviewed so that the lender can determine:

Who is affected by the “20 percent loss of income”? Is it the household or an individual? The 20 percent loss of income applies to the entire household. For example, if one person in the household loses 20 percent of his or her income, but the total household loss of income is 15 percent, that household does not qualify for this program. What are the details of the HUD counseling requirement? In order to obtain the FHA Back to Work – Extenuating Circumstances loan, you must complete HUD-approved counseling, which will address the cause of your economic troubles and help you understand actions that can help prevent you falling into hard times again. The counseling typically lasts one hour and can be done in person, over the phone or online. When does the program end? September 30, 2016. Some other FHA Back to Work-Extenuating Circumstances facts:

|

In today’s market, VA home loans outrank all other financing options.

At a time when many families are struggling to obtain home financing, the VA offers U.S. Veterans and service members a financing option unlike any other. If it were widely available, the terms of the VA home loan would make it the most popular mortgage. Instead, it’s reserved for those who have proudly served their country.

Let the VA loan program honor your service.

A VA loan allows an eligible service member to get 100 percent financing on a home without having to pay for monthly private mortgage insurance. That’s zero percent down, compared to the 3.5 to 5.0 percent down payment required on other loans. In addition, there is no cost for monthly mortgage insurance

To further save eligible service members money, the VA limits the amount the veteran can pay in closing costs and sellers are permitted to make a contribution of up to 4.0 percent.

Are you eligible?

VA makes their home loan available to veterans and active service members of the Army, Navy, Air Force, and Marines. In addition, reservists, National Guardsmen and the spouses of deceased veterans also qualify for VA benefits. Guidelines are different for active-duty and reservists, contact me and I will see if you are eligible.

The loan is not limited to first-time home buyers. In fact, it can be used over and over again, so long as it is not being used to purchase more than one property at a time. It also can be used a great option for rate and term or cash out refinance no matter what kind of loan you have now if you are already in a mortgage.

Ready to get started?

The steps are easy: Get preapproved for the loan, apply for a Certificate of Eligibility, find the home you want to buy, and negotiate the contract. Once you have a contract, the lender will order a VA property appraisal and then you close the loan and move in to the home of your dreams.

As a veteran of the US Marines and Disabled American Veterans life member I really love getting a chance to help other veterans utilize the benefits that we earned.

Original article at http://blog.phmc.com/2013/09/20/mortgage-program/va-home-loans-outrank-all-other-financing-options/

James Werner

NMLS ID # 137331

765-321-1604 Cell or Text

Closing Cost or Down Payment?

Can money from a seller be used for a down payment??

The easy answer here is no.

But……

It really can’t just be divided between closing costs vs down payments like most people think though.

It is sort of hard to grasp but it is really more complicated and simple than that.

Lets start off with removing “down payment” and “closing costs” from our vocabulary.

I would rather use words that are actually more descriptive and avoid the negative over simplifications.

I prefer to think in terms of overall “initial investment” and “credits, discounts, and service charges”

Some of the service charges after all, like appraisals or inspections have to be paid no matter if there is a closing or not so it is inaccurate to call that a “closing cost”. You also get the equity in the house for your required down payment so that is your investment and it helps reduce your monthly payments.

Some lender fees also help reduce monthly payments, so I like to just say that is your investment.How much should you invest? The less you put in to it the higher your payments are later. Then we have taxes and insurance which are just a facts of life but they are what secure and protect your investment and the community.

I usually recommend to my clients to try to ask for the seller to pay for at least some if not all of their service charges, pre paid items and other fees because it reduces the buyers funds required to close. And in some case borrowing more or paying more for a house to pay discount points or prepaid interest can save more monthly than taking a higher rate at a lower purchase price.

There are times when money is better applied to a discount point than to a down payment. Other times, particularly if the lower payment does not pay for it self in a reasonable time frame or if the buyer knows they have a very short term in a home, I recommend to pay as little as can be.

In all reality though the buyer actually is still paying for their own expenses because it is rolled in to their loan via the purchase price which might be lower if the seller did not agree to pay this expense. Or rolled in to the interest rate if there are lender credits or reductions in charges.

The Truth in Lending disclosure accounts for this “rolled in” finance charge but non lender related service charges are only initially itemized on the GFE and later accounted for on the settlement statement through invoice and receipt accounting.

We do our best to know what will be required to close but often our clients can not understand why we do not have exact numbers when we do our disclosures. They assume the process to be an exact science which it is and is not. The GFE, more than anything, try’s to explain the complexity and worst case of itemized costs involved in the loan process. The #s on it mean less than the narrative. It is after all, a good faith “ESTIMATE” so really there is no reason anyone should begin to expect that it contain actual exact numbers but it can help to explain where all of your money is going to. I have seen this disclosure change over the years from a relatively simple list of the range of charges that could be seen to a three page detailed itemization that attempts to address every possible cost and totals everything from government funding fees to specific looking assumptions about third party charges like home owners insurance, taxes, and detailed title company service breakdowns based on one service provider who may or may not be the actual company used in the transaction. Our disclosures on GFEs are usually higher than what is eventually realized in actual charges because we like to show the worst case and to error on the side of caution and consumer protection. Most of the charges on the GFE are actually assumptions about third party charges required to facilitate the transaction. In almost all cases the total of government loan funding fees, appraisal, title costs and insurance charges will exceed our origination service charges. We often can even deliver services with out charges and with lender credits from interest rate premiums we can sometimes eliminate our fees and other company’s charges. if the borrower elects that option when available.

In Indiana a lender can charge up to 5% in APR effecting fees. That is still lower than most realtors charge to list a property but our compensation is limited to compliance with federal regulations and can not change from deal to deal. Our branch office averages about 1 to 2 percent in total fees and often we credit more back than what we actually charge or can do closings with no lender fees.

The TIL on the other hand or Truth In Lending disclosure uses a complicated formula to to conceptually simplify things and accounts for the long and short of things. This document that shows the APR helps a buyer see the overall big picture.

Q:

Can the seller help with the initial investment?

Well……

There are cases where programs allow for a combined loan to value and the practice of seller held 2nd mortgages was popular before the mortgage crash. For the most part though, money for down payments has to be sourced or seasoned and funds from a seller is a big no no.

But……

The moneys in mortgage loans are somewhat fungible. Conceptually in the end it’s really just about funds to close not really what is what.

The main thing I like my clients to understand is that….

Often exact funds (to the penny) to close are unknown until a day or so from closing.

The allocation of funds will occur as needed for compliance and ultimately will be lower than anything I have shown them prior to close.

Lets take an FHA transaction with 3.5% down and a 3% seller concession on a $100,000 purchase price.

3.5% of the borrowers money or documented gift for that amount is required to be shown and must be put in to the deal as the initial investment. So $3500. A buyer might give $500 in earnest money which would reduce this after the evidence of the check clearing the bank is submitted. But the full $3500 and any other funds needed and not covered by a seller concession has to be shown in the buyers account as available.

Now from the seller….

$3000 plus the property tax credit will be applied to the total deal as a deduction from the buyers side after all service charges and loan funds are accounted for. The tax credit money is actually viewed by us as the buyers money at closing along with moneys already paid for appraisals, inspections, earnest money or lender credits.

Here the 3% paid by the seller and credits may reduce funds to close and be applied toward the initial investment of the required 3.5% the borrower has to have in the deal because the buyer will be reimbursed for money already spent which was theirs to begin with.

The loan is figured at 96.5% of the purchase price of available money for the transaction. Any government funding fees are stacked on top of the loan. In this case FHA requires 1.75% so the loan amount increases to 98.25% with 1.75% set aside to cover the fee.

I have had clients bring no money to close on FHA loans because they had large deposits in earnest and upfront and pre-paid items paid by the seller or huge tax credits that exceeded escrow set up requirements. That did not mean it was a no down payment transaction like you might really have in USDA or VA lending but it was a no cash to close situation. However the funds used still had to be sourced as money available and already invested in the deal.

I always try to get a preliminary settlement statement from the title company in advance of closing that includes our fees to get the buyer somewhat closer numbers for closing but still exact figures will be determined by other factors such as the exact closing date to calculate odd days interest and prorated taxes and there may be additional charges or changes associated with third parties beyond the lenders control.

Depending on how things shake out the $3000 could be used to refund money paid for the appraisal or homeowners insurance annual premium which in the end results less cash to close. It may not seem to the buyer that they paid this money as a “down payment” but it is included in the required investment and it may reduce what is actually needed to close so I guess that’s what it is. It is not correct to say that the seller concession was used to pay for any part of the down payment money but that is sort of what it seems like because it is money thought to be already spent.

In Indiana right now assuming normal circumstance I recommend my clients ask for about $3000 that usually covers the cost of their title work, any non government base fees we might have (excluding discount points or added origination) and provides a little help in setting up escrow accounts or for recouping money from prepaid items.

Most government loan programs allow for up to 6% to be paid by a seller for the buyers cost of doing business so you see that $3000 on a $50,000 deal might be pushing that limit and would leave no room for additional points after covering the service charges that are mostly fixed expenses. However on larger purchases there is plenty of money available to pay discount points to buy down the rate or even pre-pay interest to reduce future payments which is the basis of Platinum’s exclusive Dream Loan product where seller concessions can actually be used to provide interest free payments for up to 6 months!

James C. Werner

Branch Manager

529 Main Street Lafayette Indiana 47901

765-532-1604 Cell / Text

NMLS ID#137331

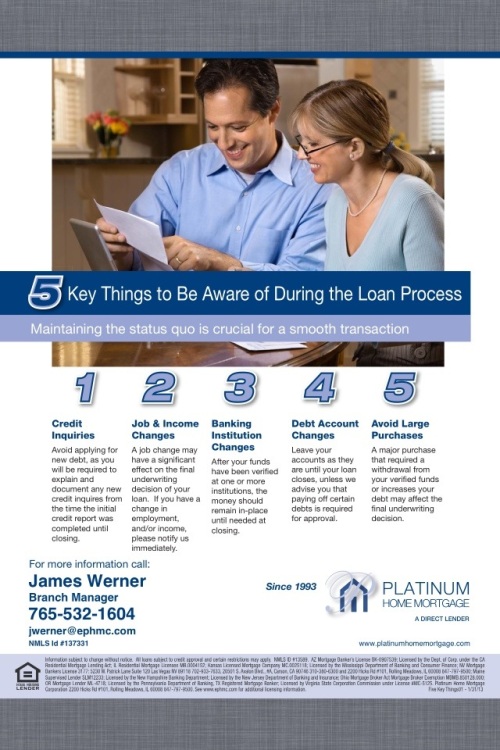

A Quick Guide to Maintaining Your Credit Profile and Scoring the Loan You Want

Applying for a home loan isn’t just about appraisals and choosing the right financing program. It’s also about your lender looking at and verifying your credit profile. Did you know that any changes to your credit profile during the loan process can have negative ramifications?

Here are a few tips and tricks I’ve put together that can help you save yourself a headache or two during the loan process.

Stay on top of paying off your existing credit accounts. One late payment can jeopardize your qualification for a home loan.

Continue to use your credit as normal. If you change the way you use credit, it could actually lower your credit score.

Call me or text if you have any questions. 765-532-1604

Don’t apply for new credit. New credit obligations can impact your debt profile and jeopardize your qualification.

Don’t close credit card accounts unless your financial advisor tells you it would be beneficial.

Don’t max out or over-charge credit cards. Keeping credit card balances at least 10 percent below the maximum should help you maintain your current credit score.

Here a few other things to keep in mind during the home loan process.

Job changes can significantly affect your loan. If you have a change in income or employment, notify your loan officer immediately.

Don’t move your money around. After your funds have been verified at one more institutions, the money should remain in place until the loan process is done.

Avoid Large Purchases. A home loan should be a big enough purchase in itself, but keep in mind that a large purchase that requires withdrawal from verified funds or increases your debt can hurt your ability to get a home loan.

James Werner

NMLS ID# 137331

765-532-1604

Is the loan approved or not?

What is the difference between getting pre-qualified for a loan, and approved for a loan?

What is loan approval?

Getting pre-qualified for a loan gives you an idea of how much you might qualify to borrow. You have not actually applied because you have not identified a property. This is more of a general conversation with the lender about your situation.

A mortgage lender could have only your word on your income, assets and liabilities. None of your information has been verified, the loan amount or term is in no way guaranteed. You may be given a pre-qualification letter that merely states you are likely to be approved for a mortgage. Getting a pre-qualification is generally very fast and you can even pre-qualify for a mortgage online in only a few minutes and it really means very little.

Getting pre-approved means that not only have you given the mortgage lender information on your income, assets, and liabilities, but your information has been checked and verified. The mortgage lender will usually have pulled your credit report to learn about your credit history and credit-worthiness.

At my Indiana office my loan officers are required to run the application through Fannie Mae’s Desktop Underwriter and our pre-approval states that FNMA has approved you.

Getting a pre-approval letter means that you are likely to be approved for a mortgage and also states the amount for which you may be approved. It carries much more weight than a pre-qualification letter.

It’s important to remember that you are not guaranteed to get a mortgage just because you are pre-approved or pre-qualified even if you are clear to close nothing is ever final in spite of what they call it. Even “loan commitment”

Would still have conditions for docs or funding conditions before you can get the keys or the deed is transferred or checks can be cashed.

In this business nothing is done until its done. I have had borrowers get fired from jobs or quit the day of closing or take on new debt that we were not told about. I even have had houses catch fire and flood just days before closing.

And a few times the sellers could not close because they had to bring money to the closing they did not have or had another house to sell that did not go through. Anything can happen!

Many things can happen during the process—some lenders may give out pre-approval letters without actually verifying your information or a borrower may not give completely accurate information about their situation.

Often during the verification and documentation process new stipulations are created. For instance in documenting income it may be discovered that there is a 401k loan or a divorce decree may disclose other liabilities like child support or other undisclosed monthly payments that can change debt to income ratios.

The life of a loan transaction from the lenders perspective begins when a prospect decides to move forward and become a borrower by taking a full application. Over the phone we can usually conclude if someone has a chance. We have no application fee or charge to run credit so if they are serious it begins with authorization to do a basic credit check. Our reports are

very detailed and we always show the full report to our clients so they can see what we see.

We also try to collect as much income information and documentation as we can to help the client identify the right price range. We also talk about assets and where down payments or closing cost money is going to come from if it is needed. (We often have no cost options available and no down payment programs as well allow for gift funds etc)

Once a buyer finds a house and gets ready to make an offer we use the address and terms to process the credit, income and asset information through Fannie Mae’s desktop underwriting system.

We also use other Automatic Underwriting Systems (AUS)

Like Freddie Mac’s LP (Loan Prospector) and GUS ( Government Underwriting System)

We use DU because if it passes it it will usually pass the others. But LP or GUS might have different findings.

Loans are “graded” by Fannie DU as:

Underwriting Recommendation What It Means:

Approve/Eligible

Based on the data submitted, the loan is eligible for Fannie Mae’s limited waiver of certain mortgage eligibility and underwriting representations and warranties, and if all conditions have been met, the loan is eligible for delivering to Fannie Mae.

Approve/Ineligible

The loan is eligible for Fannie Mae’s limited waiver of certain mortgage eligibility and underwriting representations and warranties, and if all conditions have been met, the loan is eligible for delivering to Fannie Mae. However, the loan does not meet the eligibility requirements specified by Fannie Mae, FHA, or VA. An underwriter must determine if the condition that caused the ineligibility can be resolved or if the lender has a negotiated contract that allows the ineligible condition.

Eligible/Ineligible

Loans receiving EA-I/Eligible, EA-II/Eligible and EA-III/Eligible recommendations meet the Fannie Mae eligibility Requirements. Despite the borrower’s credit risk, EA expands eligibility to borrowers who would have otherwise been reliant on higher-cost nonprime products by offering more conventional financing.

Refer/Eligible The loan meets the Fannie Mae, FHA, or VA eligibility requirements. DU evaluated a combination of risk factors, including assets, each borrower’s credit history, each borrower’s employment status, the property type, and the purpose of the loan. Based on the data submitted, DU is not able to recommend approval for the loan.

Refer/Ineligible

The loan does not meet Fannie Mae, FHA, or VA eligibility requirements. DU evaluated a combination of risk factors, and based on the data submitted, the system is not able to recommend approval of the loan. In addition, the risk analysis did not take into consideration any additional credit risk that might be associated with the ineligibility condition.

Refer with Caution

DU evaluated a combination of risk factors, and based on the data submitted, the loan does not appear to meet the credit risk of loans that receive a Refer recommendation. This recommendation is not used for government loans.

Out of Scope

DU does not contain the rules or models that are necessary to underwrite the product, borrower, or type of loan submitted. Therefore, underwriting results may not be valid.

We only issue pre approvals to people who are “Approve/Eligible”

And when the purchase agreement is final and we check it for errors or missing information then we continue to process the loan getting the entire application signed and documented.

In my office we run our own fraud test and flood certification as well as geocode the property, we verify employment and phone numbers and addresses we are given, verify social security numbers and check with the IRS to make sure people filed their taxes. We order title and appraisals review them for errors or red flags

if all of that makes sense we can have our underwriters review the file for closing. They will review everything and can ask for additional documentation.

They will assign loans a status. Most start with “suspended” until compliance and basic qualification information is verified then if they are not denied they are approved with conditions or “clear to close” once a loan is clear to close our in office closer reviews all compliance information and request final documents. The final documents are prepared and sent to the title company who then sends us the settlement statement for approval and

then the loan is ready for signing .

Even at this late stage of the game there can be funding conditions but we wire the money (electronic transfer) to the title company. Once the funding conditions are met such as the buyer and or seller having their money if needed, signing everything (including a statement that nothing has changed)

Only then is the loan closed.

A good guide for loan officers having trouble with DU trying to understand what the code mean can be found here

:

Is it a Home Inspection or a Home Appraisal?

Is it a Home Inspection or a Home Appraisal?

Buying a home is one of most important and expensive purchases you will ever make. Both you and your lender need to know that the home you’re buying is everything you believe it to be. You will want to know that the home is free from any material defects and the lender needs to know that there is adequate value for the loan. As this infographic illustrates, a home inspection is used to find material defects in the home and the home appraisal is used to determine the property’s market value.

Inspecting for Defects

Home inspections are not required for your mortgage loan; however, it is recommended that every home buyer get one and make it a contingency of the sale. Once the home buyer or their agent orders the inspection, a home inspector will visit the home to check items such as roofing, flooring, windows, plumbing, and electrical systems for material defects. Home buyers are welcome to be at the home during the inspection. This is a great opportunity to find out the ins-and-outs of the home’s various systems. If defects are found and the seller agrees to repair the issue, the work must be completed prior to closing.

Appraising for Value

Appraisals are required for your mortgage loan, so that the lender can determine the home’s collateral value for the loan. Your lender will order an appraisal from a certified home appraiser, who will check the overall condition of the property, measure the home and note any remodeling. They will also check for basic health and safety items and compare the property to similar properties that were recently sold in the neighborhood. A formal appraisal report is issued to the lender and home buyer noting the property’s value.

Give me a call at 765-429-4444 for an appointment or visit me online at http://www.ephmc.com/jwerner